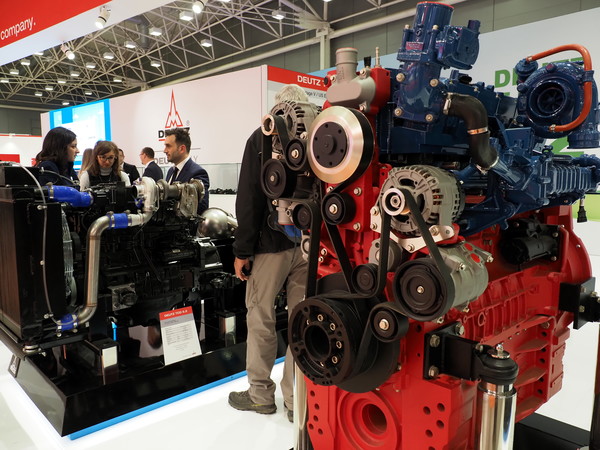

Component manufacturers, market in decline in 2024

Mondo Macchina interviewed the president of Comacomp Fausto Mazzali on the short and medium term market prospects for the component sector. 2024 looks like a year full of challenges and uncertainties for Italian manufacturers

In the agricultural mechanics market – a large and diversified market – the components segment stands out for its transversality and for a trend that in some circumstances has had anti-anti-cyclical characteristics. From pumps from gearboxes, dashboards to sensors, to control units and transmission systems, those who produce components meet a very diverse demand, generated not only by the agromechanical sector, but also - to name a few - by the automotive or earthmoving sector. This transversality allows manufacturers to “diversify risk”, compensating for any declines that may occur in a specific product category. FederUnacoma estimates indicate that in the period between 2018 and 2023 the value of the production of made in Italy components increased by 40%, reaching 3.8 billion euros. However, growth could be interrupted during 2024, a year that already in these first months is presenting challenges and unknowns for Italian component manufacturers.

Mondo Macchina spoke about these issues with the president of Comacomp Fausto Mazzali, analysing the market prospects in the short and medium term.

In these first months of 2024 the sentiment of operators appears to be marked by a certain caution, and a clear turnaround is not expected compared to 2023, although the second part of the year could see an improvement in the scenario. Could the component segment have an anti-cyclical trend or could it be affected by the general market trend?

Unfortunately, the signs that have been coming since the beginning of the year are very negative and indicate a substantial decline in demand. For the first quarter we expect a double-digit percentage decline compared to the same period in 2023 and also for the following months the sentiment of operators appears pessimistic. In short, a possible recovery of the sector is not yet on the horizon. The trend of components in 2024 will not be anti-cyclical, but will be closely related to the negative trend that is characterising the agricultural machinery and equipment market. The hope remains to see, data in hand, what the trend of the sector will be when manufacturers start manufacturing the new machines for 2025.

The geopolitical variable, with the opening of the second front in the Middle East, continues to affect the raw materials market, logistics and world trade routes. The further deterioration of the international scenario risks compromising the measures put in place by the industry to deal with the emergency...

Certainly the international political instability is a strong aggravating factor for the markets and today, unfortunately, the desired signs of détente so necessary to promote business development are lacking. In particular, logistics marks a serious increase in container costs and this obviously penalises us compared to those with shorter supply chains. While energy costs are aligning with those before the invasion of Ukraine, unfortunately inflation and the consequent cost of money are still particularly high, thus resulting in a penalty for our companies that see the costs related to the processing of the product still too high to be competitive.

The anti-crisis measures put in place by component manufacturers to withstand the difficult economic situation of 2022-2023. But the success of Italian brands is not only due to short-term strategies that have strengthened their resilience. It is mainly due to the strengths of Made in Italy, which has always made the difference compared to competitors...

Undoubtedly Made in Italy is a distinctive brand that facilitates the possibility of weaving new relationships, and the characteristics that distinguish us from foreign competitors are certainly known. I emphasise the innovative capacity of our companies whose ability to change processes, products and business models is recognised globally. Innovation, competence, flexibility and speed in adapting their offer to the needs of customers, which are changing in ways that seem increasingly urgent, represent the ways in which Italian companies know how to stand out and win in the market. I would say that today in a world where the only certainty is uncertainty, we Italians probably start with an advantage.

On 3 July, FederUnacoma renewed the institutional charges of the Federation and the federated bodies that represent its product divisions. The association of component manufacturers also renewed its governing bodies, electing you as president. What are Comacomp's priority areas of intervention over the next 4 years?

Since serving on the Comacomp Board I have always been able to appreciate a distinctive vibrancy in our companies in terms of internationalisation. Our association actively participates in all initiatives aimed at foreign markets organised in collaboration with ICE Agency and MAECI and certainly this will be an activity on which we will keep a strong focus. The digitalisation of our companies is another topic of great interest as we believe that digital transformation is an unavoidable event if we think we want to compete globally. This theme is closely linked to that of data whose management becomes real know-how with which to better manage value propositions. Sustainability and training are the other two long lines to work on to raise awareness among our associates on relevant current issues. I therefore express a very strong appreciation for the birth of AFI, the school of higher education recently conceived by FederUnacoma.