Brexit, duty-free with new preferential origin

The Trade and Cooperation Agreement (TCA) signed between the EU and the UK last December provides for the elimination of duties and customs quotas in trade between the two blocs. But this only applies to goods with 'preferential origin' in the EU or the UK

The TCA mitigates (but does not nullify) the effects of the reintroduction of customs procedures in trade between the two blocs by cancelling customs duties at the UK border only on condition that the product can be said to be of "EU preferential origin". The same rules apply, of course, to UK products destined for the European common market.

In particular, the products must meet three distinct conditions. In terms of substance, the goods must fully comply with the preferential rules of origin laid down in the text of the Agreement and the ORIG-2 Annex. In addition, the exported goods must be accompanied by proof of such origin and, finally, as a third condition, the product must be transported directly from the European Union to the United Kingdom and not be subject to any handling during transport, in accordance with the non-modification rule (Article ORIG.16).

From the point of view of an Italian company exporting its products to the UK, it should be noted that, in order to benefit from zero customs duties, the goods sold from the EU to the UK must comply with the rules set out in the Agreement and can be defined as being of “preferential origin”.

Firstly, all products "wholly obtained" in an EU Member State, such as those resulting from agriculture, livestock breeding and fishing (ORIG.5) are therefore entitled to zero duty. These are, in particular, goods which have a direct link with the territory, such as mineral, vegetable or animal products, or an indirect link, in that they are mediated by human activities, such as products extracted from the soil or from the marine subsoil. Such goods certainly benefit from "preferential treatment".

Products manufactured in an EU Member State exclusively from materials originating in the European Union are also considered to be of EU preferential origin and are eligible for zero duty on import into the UK (Article ORIG.3). This category of goods differs from the previous one, because they are finished products made from materials that have several components or have undergone several processes. In this case, the traceability of each component is important, as each material, individually considered, must be of EU origin.

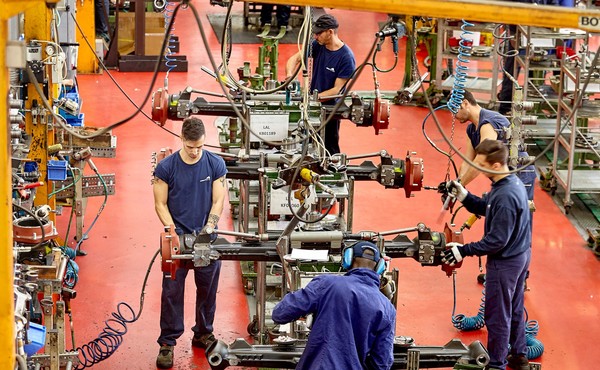

Finally, products manufactured by processing foreign raw materials or using components made in third countries in the manufacturing process are entitled to zero duty in the UK, provided that they meet the requirements set out in the ORIG-2 Annex. In particular, this concerns all goods that have undergone one or more working operations in the EU territory and that incorporate non-originating materials. In these cases, preferential origin is recognised for products that have undergone “sufficient processing” in the EU, as defined by the text of the Agreement and, in particular, by the ORIG-2 Annex, which requires very careful and precise examination.

The ORIG-2 Annex provides for specific rules of origin for each type of product in relation to the various customs headings. In order to correctly establish preferential origin, it is therefore necessary to start from the correct customs classification of the exported goods.

In general, the workmanship that qualifies for preferential origin is determined according to the usual criteria in free trade agreements: change of customs classification, a particular production process, a minimum value or weight of non-originating components.

Assuming, for example, that the product "wine" is to be exported, the rule of origin applicable to CN heading 2204 must be checked. For this specific heading, preferential origin is granted if the processing of the non-originating material is capable of bringing about a change in the classification of the final good, provided that the fresh grapes used (subheading 0806 10) are "wholly obtained" in the EU territory. Likewise, the grape juice variables (including musts) must be wholly obtained in the EU territory, while the non-originating sugars used in the production process may not exceed 20 % of the weight of the final product.

It should also be noted that, in relation to certain types of goods, the Agreement provides for two alternative rules of origin. This is the case, for example, for an Italian company producing handmade leather handbags (CN 4202 2100 10) using non-EU originating components. The handbag manufactured in the EU acquires EU preferential origin if the processing resulted in a change in the customs heading (first 4 digits) of the non-EU components used. In this specific case, the Agreement provides that, even if this condition is not met, the final product can still benefit from zero duty, if the value of the non-EU originating materials used does not exceed 50% of the ex-works price of the final goods.

The Agreement also lists a number of operations that are always considered insufficient, such as labelling or mixing non-originating products. Such operations can never be considered as eligible for the acquisition of preferential origin (Article ORIG. 7). The rationale of the rule is to avoid the recognition of zero duty in the UK for goods of non-EU origin that receive only marginal handling or a simple change of packaging in the European territory.